Introduction

- The Bank of England, like many Central Banks around the globe, is considering introducing a digital currency, the ‘Digital Pound’.

- Rather than a new currency, the ‘Digital Pound’ will be a form of central bank electronic money that will stand alongside physical cash (also a form of central bank money) and could be used by households and businesses to make payments.

- It will act in the same way as physical cash that can be carried in your wallet, however it will most likely be in the form of a card or a phone app and could be used in the way bank cards or apps are used today.

- It would be designed for everyday payments – both in-person and online – and would be a direct claim on the Bank, in the same way a bank note is today.

What Might a Digital Pound Look Like?

As the Bank of England and HM Treasury are still working on the design it’s too early to describe what a Digital Pound will, or even might, look like. However, there are key features that are already being considered that are worth noting. These are:

- It will be issued/distributed via a central platform operated by, but situated at arm’s length from, the Bank of England

- Private sector firms will be engaged to act as secondary distributors or intermediaries

- It will most likely be accessed through cards or smartphone apps

- It will be seamlessly exchangeable with other forms of money including cash and bank deposits

- It will be used by households and businesses for everyday payments, both online and ‘in-store’

- It will be accessible to both UK residents and non-residents

- It will not replace, but rather exist alongside, traditional cash

Key Design Attributes

Privacy

- Privacy is a major concern around the introduction of a CBDC. The Bank is looking to design a system that would restrict it’s own visibility of data held on the platform, and at the same time only allowing intermediaries the minimum necessary access to transaction data needed to provide CBDC services and to fulfil their legal and regulatory obligations.

Security

- Alongside the need for privacy, the need for security is also a significant design criteria. This applies to both Bank of England and customer security.

Resilience

- The CBDC system will need to be resilient to disruption. Disruption may have far-reaching consequences for user confidence, data integrity and financial stability.

Performance

- The CBDC system will need be able to handle a high volumes of transactions and confirm and settle these transactions as quickly as possible. The Bank estimates that throughput of approximately 30,000 transactions per second, and confirmation and settlement in under one second, might be needed.

Extensibility

- The CBDC system should have an extensible design, allowing intermediaries and other approved third parties to implement additional functionality without affecting user services. The Bank might also examine the implications of using open-source components, and any vulnerabilities that may arise due to third-party dependencies.

Energy Usage

- The CBDC system should be energy efficient and designed in a way which minimises any impact on the environment.

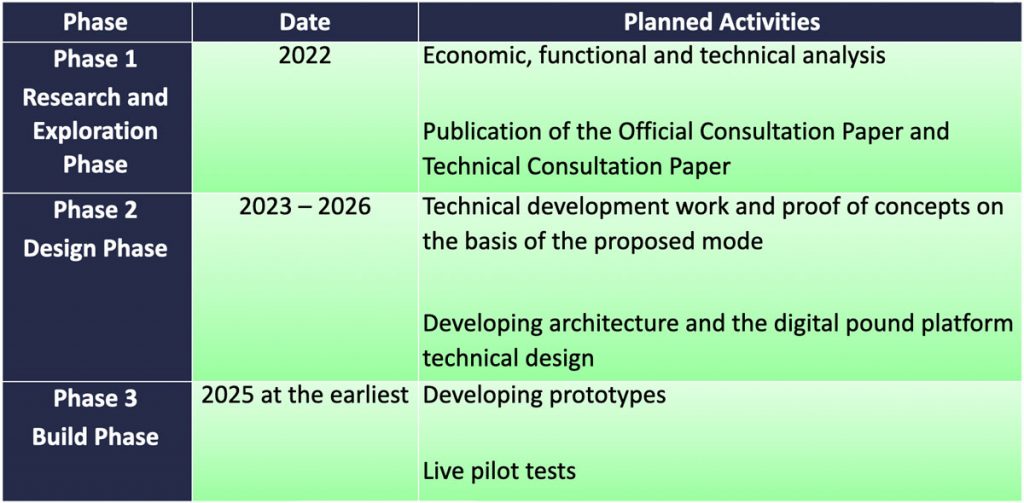

When Is This Likely To Happen?

The Bank has stated that the following activities will now need to be undertaken:

- Determine the technological feasibility and investment needed to build a digital pound

- Articulate, in detail, what the technology and operational architecture for a digital pound would look like

- Assess and evaluate the benefits and costs of the digital pound architecture

- Deepen the Bank’s knowledge of CBDC technology and the private sector’s understanding of our technology approach

- Support the development of the broader UK digital currency technology industry through experimentation and proofs of concept

- Provide the basis for a future decision on whether to introduce a digital pound and move to a ‘build’ phase

Why is the Bank of England Looking to Introduce a Digital Pound?

- A common question being asked at the present time is ‘Why does the Bank of England feel the need to introduce a Digital Pound?’

- There are a variety of reasons why the Bank is looking at the possible introduction of a Digital Pound.

- One of the main reasons is the growth of privately owned financial services and technology. With the introduction of a Digital Pound, the Bank is looking to ensure its role as an anchor for confidence, stability and safety in the UK’s monetary system.

- Another reason is the need to respond to the major change that’s being seen in the UK economy, especially since the pandemic, which is the reduction in the amount of physical cash in use.

- A further reason is to improve the efficiency of the overall payment systems.

Is a Digital Currency a Form of Cryptocurrency?

- No. Central Bank Digital currencies can be issued in the a form of a cryptocurrency, hosted on blockchain technology, but don’t have to be.

- The Bank of England isn’t looking to blockchain as the means of hosting their digital currency offering – so there’ll be no Bank of England ‘BritCoin’.

- The reason for this is that the current plans by the Bank of England are to make the new digital currency as widely available as possible.

- As of 2023, the current blockchain technology couldn’t support the volumes of transactions envisaged (approx. 30,000 per second as mentioned above).

References and Further Reading

Bank of England and HM Treasury

“The Digital Pound: a New Form of Money for Households and Businesses?” Consultation Paper. February 2023

Link: https://www.bankofengland.co.uk/paper/2023/the-digital-pound-consultation-paper

Bank of England

“The Digital Pound, Technology Working Paper” February 2023

Link: https://www.bankofengland.co.uk/paper/2023/the-digital-pound-technology-working-paper

The House of Commons Library Research Briefing

“Central Bank Digital Currencies: The Digital Pound”

Link: https://commonslibrary.parliament.uk/research-briefings/cbp-9191/

Andrew Baily Speech

“New Prospects for Money” – speech by Andrew Bailey, Governor of the Bank of England. 10th July 2023

Link: https://www.bankofengland.co.uk/speech/2023/july/andrew-bailey-speech-at-the-financial-and-professional-services-dinner